Secure Your Trip to Thailand with the Right Travel Cover

From verdant valleys and isolated tropical islands to glamorous coastlines and cities, Thailand is a wanderer’s dream. This southeast Asian country has become an enigma for backpackers and luxury travellers, not just because of the attractions but also because of its modern tourist infrastructure and safe, friendly reputation. Your trip to Thailand can be a life-changing experience if you keep some basic tips in mind starting from prior arrangements for bookings and accommodation to buying travel insurance for Thailand.

No matter how well-planned your trip is, unforeseen emergencies can strike anytime to ruin the travel excitement. That’s where travel insurance comes into play.

Care Health Insurance plans brings you a travel insurance plan that offers much-needed protection during any medical or non-medical exigency abroad. From immediate cashless hospitalisation to reimbursement for medical and non-medical emergencies such as loss of checked-in baggage, trip delay/cancellation, and assistance in case of loss of passport, the policy will cover you for all.

When Can Travel Insurance for Thailand be Helpful?

Certain apprehensions are bound to come with a trip abroad. However, if you have secured your trip with travel insurance for Thailand, you can enjoy your trip worry-free. Here are a few unprecedented encounters where you would not have to worry if you had bought travel insurance beforehand.

- Costly Medical Expenses: Thailand is more expensive than India. Moreover, being hospitalised during your trip would be the last thing you want to experience. These unplanned expenses during your travel can derail your finances. However, you would not have to worry about hospitalisation expenses if you have covered yourself with the right travel insurance plan for Thailand.

- A missing passport or checked-in luggage: Losing your passport or one of your baggage in Thailand is unfortunate. The costs of retrieving the items at the airport or the local police can drain your budget. However, by buying a travel insurance plan from Care Health Insurance, you can rest assured of the expenses and focus on retrieving your belongings.

- Dental Care Needs: Suppose you encounter a fall that has affected your denture during your trip to Thailand. In such a case, your travel insurance can indemnify any emergency dental treatment.

- Trip Cancellations: Any unprecedented trip cancellations can derail your budget. The non-refundable cancellations of flight tickets and other pre-bookings can leave a hole in your pocket if you do not have a travel insurance plan. However, if you have one, you do not have to worry about trip cancellations due to specified situations.

- Repatriation of Mortal Remains: An unfortunate accident during the trip may lead to the death. In such a case, your travel insurance can help by reimbursing your costs of carrying the mortal remains of the deceased back home.

Is it Mandatory to Get Travel Insurance in Thailand?

The Thai government has made it mandatory for foreign citizens entering Thailand to have medical insurance. For travelling to Thailand, a mandatory COVID-19 travel insurance policy explicitly states the traveller has coverage for medical care if they contract COVID-19. Travellers whose insurance plans do not specifically cover for this requirement may be denied entry into Thailand. Furthermore, travel insurance for Thailand must have a minimum coverage level of $10,000 USD (or approximately 3.5 million Thai Baht) to cover medical treatment availed by the applicant and be valid for the duration of the visit.

What are the Features of Thailand Travel Insurance?

No matter what your travel purpose is, we've got you covered to make your journey joyous and stress-free. Summarising below the features of opting for the best travel insurance for Thailand:

-

Affordable Premium: The travel insurance plan for Thailand has been carefully designed to cover all your medical and non-medical needs within an affordable premium.

-

Automatic Trip Extension: In case of an unfortunate demise, occurrence of a natural calamity, or prolonged hospitalisation, the policy automatically gets extended for up to seven consecutive days.

-

Cashless Claim Processing: Our wide network of healthcare providers available overseas helps you avail of cashless in-patient care in case of an emergency. This can be availed by simply calling us during emergencies.

-

All-inclusive Protection: Whether you need healthcare attention or assistance during non-medical emergencies such as loss of checked-in baggage or passport, we have your back at every step of your journey.

-

Useful Add-on Benefits: The policy helps you customise and secure frequent and long-duration trips with optional covers like PED coverage, refund of visa fees, etc.

Thailand Travel Insurance Plan at a Glance

While covering your trip to Thailand with a travel insurance plan, it is very important to understand the major highlights of the plan carefully. Before buying a plan, you should always compare travel insurance from multiple providers and determine whether you need standalone, student travel insurance or travel insurance for senior citizens.

You should also understand the frequency of the trip to determine the cost of your plan’s premium. Here are a few important highlights of the Explore Asia plan that can help you understand the plan.

| Description |

Explore Asia |

| Sum Insured |

US $ 10K, 25K, 50K & 100K (Vary according to the premium) |

Trip Options

- Single Trip

- Multi-trip (Policy will be on an annual basis)

|

Yes

Yes |

| Entry Age (Single Trip) |

Minimum: Child- 1Day, Adult- 18 Years

Maximum: Child- 24 Years, Adult- Lifelong |

| Entry Age (Multi-trip) |

Minimum: Child- 1 Day, Adult- 18 years

Maximum: Child- 24 Years, Adult- Lifelong |

*Family option is only available on Single Trip Policies. Please refer to the prospectus for more details on eligibility.

What is Covered under Travel Insurance for Thailand?

We offer comprehensive travel insurance policies with the below-mentioned coverage under Thailand travel insurance:

- Emergency Hospitalisation: If you find yourself in a medical emergency requiring hospitalisation, the travel insurance plan will provide you with complete coverage encompassing IPD and OPD expenses.

- COVID-19 Coverage: We offer COVID-19 coverage to keep you worry-free during a health emergency incurred due to an infection of the Covid-19 virus.

- Trip Delay, Cancellation, or Interruption: Any cancellations, delays, or other interruptions in the trip shall be covered under your travel insurance plan.

-

Compassionate Visit: We offer a reimbursement facility for flight ticket (economic class category) costs to an immediate family member in case the insured is hospitalised.

-

Personal Accident: Travelling abroad can bring many uncertainties, and accidents are among them. Considering such worries, we cover Accidental Death/Permanent Total Disability, requiring urgent and immediate medical attention.

-

Daily Allowance: The additional everyday expenses of a companion can be reimbursed under our reimbursement benefit for up to a specified amount as per the policy terms.

- Loss of Passport and Checked-in Baggage: You can get coverage up to the sum insured for loss of passport and checked-in baggage or delay of checked-in baggage.

- New Coverage Benefits: We have widened our horizon and offer coverage for Missed Flight Connection/Hijack Distress Allowance/Automatic Trip Extensions to keep unnecessary stress at bay.

*Refer to the policy documents for more detailed information regarding the Coverage.

What is Not Covered under Travel Insurance for Thailand?

It is beneficial to check the exclusions of the travel insurance policy,to avoid any last-minute surprises. Some of the exclusions under the Explore-Asia travel insurance for Thailand by Care Health Insurance are given below:

- Drug Misuse: Any unwanted expenses incurred due to misuse/ abuse of drugs or alcohol shall not be indemnified in the travel insurance plan.

- Self-inflicted Injury: Any injury caused due to suicide attempt, or any other form of harm to self leading to hospitalisation or death shall not be covered within the plan.

- Breach of Law: Any liability or injury expenses arising due to breach of law or particular regulations set by the destination country shall not be covered in the plan.

- World War: Any medical or non-medical expenses arising from national or international war, nuclear perils, or consequences thereof.

- Hazardous Activities: Any claims relating to hazardous activities like fire stunts, road stunts, etc., that are otherwise not mentioned in the policy documents.

- Dental Treatment: Expenses of any planned dental treatment or surgery unless necessary due to acute pain.

Note: Plan features, benefits, coverage, and claims underwriting are subject to policy terms and conditions. Please refer to the brochure, sales prospectus, and policy documents carefully.

What is the Premium of Travel Insurance for Thailand?

The premium that the insured must pay will be based on various factors, including the age of the traveller, the country he/she is travelling to, trip duration, and the type of coverage selected. The Thailand travel insurance plan offered by Care Health Insurance is budget-friendly to ensure all your medical and non-medical needs are covered without leaving a hole in your pocket.

Care’s travel healthcare insurance premium for the Thailand zone starts from as low as around Rs. 471* for a single traveller on a 10-day-long visit. For instance, if you are travelling from India to Thailand on a 10 day, one-time visit, the approximate premium cost of your travel insurance with a sum insured of $50k is calculated as below:

| Insured Member(s) |

Age |

Any Pre-existing Disease |

Sum Insured |

Policy Duration |

Premium Amount (approx.) |

| 1 |

30 years |

No |

$50, 000 |

10 Days |

Rs. 471* |

*The above-mentioned travel insurance premium is calculated subject to no pre-existing medical conditions of the insured members. It considers that the insured members have not been diagnosed, hospitalised, or underwent any treatment in the last 48 months. Also, the premium amount is subject to change if the insured person has already claimed any travel policy before.

Check: Travel Insurance Premium Calculator for calculating the cost of your travel insurance premium.

Things to Keep in Mind Before Buying Thailand Travel Insurance

When selecting travel insurance for Thailand or any southeast Asian destination of your choice, you must ensure that the plan suits your requirements. Here are the factors to be considered.

- Nature of the Trip: Frequent fliers should go for multi-trip plans; others should go for a single trip travel insurance plan.

- Trip Duration: The premium is decided based on the number of days spent in Thailand. The shorter the trip, the lower the premium.

- Medical History: If you have any serious ailment, ensure that the policy covers it.

- Check the Coverage: Take a close look at the inclusions to know what is covered in the Policy. The overseas travel insurance plan has maximum benefits and an affordable premium.

- Review the Exclusions: While on a trip, you might not want to be surprised and know that your travel plan does not cover certain expenses you assumed it would. Hence, read the policy exclusion and plan your trip.

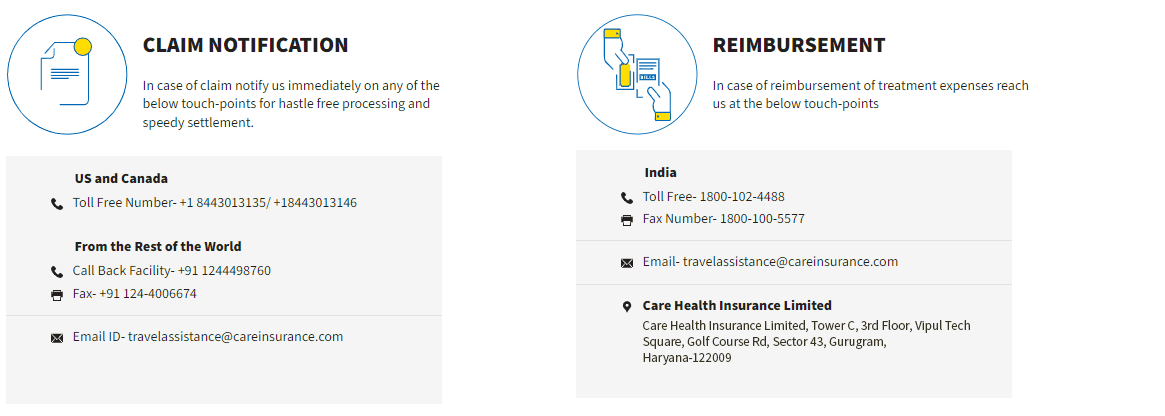

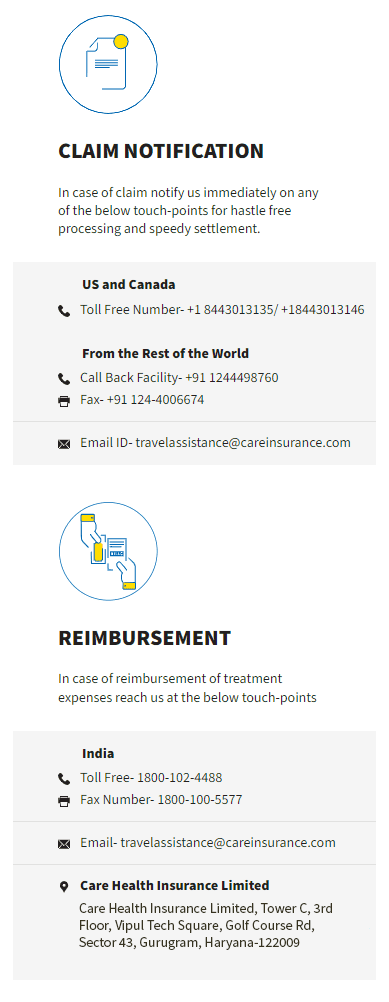

How to File a Claim Under Travel Insurance for Thailand?

What are the Types of Visas for Thailand?

There is an option of getting a visa on arrival for Indian passport holders in Thailand for tourism if they stay for less than 15 days. They can obtain a visa from the Thailand Embassy or at any immigration checkpoint located at an International airport in Thailand.

Based on the purpose of your visit, there are different types of Visas that can be availed of. Below are the types of visas you can avail:

- Tourist Visa: This type of Visa is issued either for single or multiple entries. The tourist can stay in Thailand for up to a period of 60 days. It can further be extended to an additional 30 days.

- Non-immigrant Visa: This type of visa allows travellers to stay up to 90 days in the country. It is assigned for a single entry.

- Non-immigrant B-Visa: This type of Visa is applicable to travellers visiting Thailand for business purposes.

- Non-immigrant Ed-Visa: Those who are visiting the country for education or pursuing vocational courses should apply for this Visa. It will be available with the help of a recommendation letter from the authorised body.

- Non-immigrant O-Visa: If you are planning to retire in Thailand, start work or settle in the country after getting married to a Thai national, you will need to apply for a Non-immigrant O-Visa or Marriage visa. To avail of the retirement visa, you must be above 50.

- Permanent Resident Visa: You must avail of this type of Visa if you reside in Thailand for 3 years or more.

How to Apply for a Thailand Visa?

Here is the application process for Thailand visa for Indians:

- Category: Choose the right visa category depending on the purpose of your visit to Thailand and download the visa application form.

- Fees: Payment of visa fees can be made through credit/debit card or net banking.

- Documentation: The required documents must be submitted online at selected destinations or the branch.

- Receive visa: You will get updates on your visa status on a real-time basis, and on approval, receive your visa.

Important Documents Required for Thailand Visa Application

You should possess the following documents while applying for a tourist visa for Thailand:

- Passport or travel document valid for at least 6 months.

- Form for requesting a visa (filled out).

- One (1) recent 4x6cm photo of the applicant.

- Round-trip air ticket or digital ticket (completely paidl).

- Financial evidence (20,000 baht per person/40,000 baht per family).

- Proof of hotel or private lodging.

Important Things to Know about Thailand

| Category |

Specification |

| Capital |

Bangkok |

| Official Languages |

Thai (Siamese) |

| Currency |

Thai baht |

| International Airport |

Suvarnabhumi Airport. There are 6 other airports namely:

- Don Mueang International Airport

- Phuket International Airport

- Chiangmai International Airport

- Chiangrai International Airport

- Hat Yai International Airport

- Samui International Airport

|

Get yourself a comprehensive travel insurance plan at an affordable premium and make your trip to Thailand fully secured.

>>Also Read: Best Places to Visit in Thailand